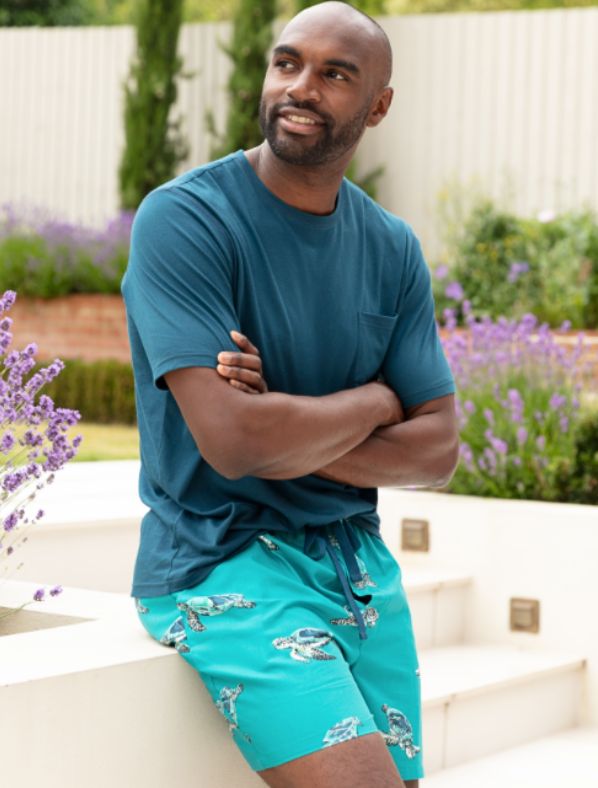

Welcome to the Cyberjammies comfort club. Find your perfect nightwear style to take you from sleepy nights to cosy mornings. Award winning comfort, luxuriously soft in fun and bright designs!

Welcome to the Cyberjammies comfort club. Find your perfect style, from t-shirts and shorts to pyjama sets in uniquely fun prints! Whatever you decide you're always guranteed award winning comfort!

Kid-proof pyjamas never looked so good! Durability is key when it comes to our Minijammies pyjamas, but that doesn't mean they won't still feel our award winning comfort when they fall asleep.

Make Sunday lie-ins more fun with matching pyjamas for everyone. Award winning comfort the whole family can enjoy!

The ultimate in timeless sophistication. Nora Rose was lovingly created for customers seeking nightwear that combines classic styles with an elegant twist. Made from beautifully soft and breathable fabrics and finished with exquisite detailing that will elevate your bedtime routine.

Find all of your favourites in the Cyberjammies sale. Award winning comfort for less!

Whether you are looking for floral pyjamas, wedding nightwear, accessories or that perfect gift, check out our edits to help you find the perfect comfy PJ's for you!

Find out more about us here at Cyberjammies, who we are, what we do and why we do it! We can't wait to welcome you to the Comfort Club!

Find a list of our top searches to help you today!

Still can't find what you're looking for? Don't hesitate to get in touch with our Customer Service team here.